The Lazy Saver's Guide to TopCashback: Set It, Forget It, and Stack Your Cashback

- kbsmall4

- 6 days ago

- 3 min read

You're leaving money on the table. Right now. That online cart you just abandoned? The birthday gift you ordered last week? The hotel you booked for vacation? Each one was a missed opportunity for a silent rebate-cash that goes straight back into your pocket for doing nothing differently. This isn't a side hustle. It's a smarter way to spend.

How TopCashback Works

The model is elegantly simple. TopCashback is a bridge between you and over 7,000 retailers. When you click from their site to a store like Walmart or Best Buy, the retailer pays TopCashback a commission for the referral. TopCashback then gives that commission back to you as cashback.

The process is a three-step rinse and repeat:

Start Here: Log in, find your store on TopCashback, and click the "Get Cash Back" button.

Shop Normally: Complete your purchase on the retailer's site. Don't close tabs or use other coupon extensions that might interfere.

Get Paid: The purchase tracks, the cashback appears in your account, and once it's confirmed (after the retailer's return period), you can cash out to your bank, PayPal, or a gift card-often with a bonus.

This simplicity is its power.

Why TopCashback is Your Perfect Foundation

Using one cashback app is good. Intelligently stacking them is how you graduate from saving to profiting from your spending. TopCashback's high baseline rates make it the ideal base layer for this strategy.

Your Ultimate Shopping Stack Blueprint:

Layer 1: TopCashback. Always start here for the highest possible base rate. Use their browser extension for automatic alerts.

Layer 2: Store Coupons & Credit Card Rewards. TopCashback encourages you to "click our coupons" on their retailer pages and use a cashback credit card. This is free, stacked savings.

Layer 3: The Guarantee Check. Before clicking "buy," do a 30-second check on one other major portal (like Rakuten). If you find a higher rate, use TopCashback's claim form to get 110% of that rate.

To visualize where TopCashback fits in your arsenal, here's how it compares to other popular portals:

The Real Deal: What You Can Earn & The Fine Print

TopCashback reports the average member earns over $400 a year. For strategic stackers, that number is a starting point. Imagine earning 8% back on a $500 hotel booking, then adding 2% from your credit card, and a $20 welcome bonus from the hotel's own program. The compound effect is real.

However, an honest review requires looking at the challenges. The most common user complaint on Trustpilot involves tracking issues-where a purchase doesn't register for cashback. TopCashback's process requires patience; cashback can take up to 14 days to appear and months to become "payable" as they wait for the retailer to confirm the sale.

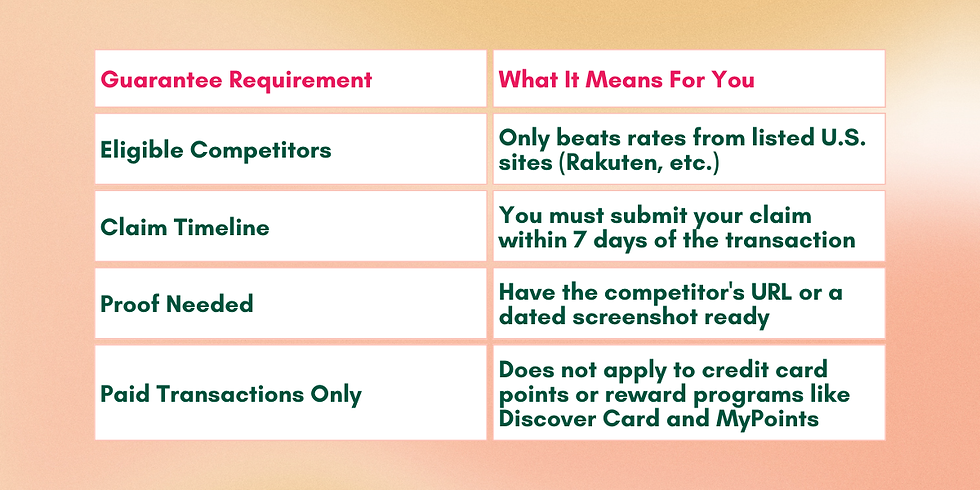

Their flagship "Highest Cash Back Guarantee" also has specific rules you must follow to qualify (1)(2).

Who Should (and Shouldn't) Use TopCashback?

TopCashback is your new homepage if: You're a frequent online shopper, a strategic saver who doesn't mind a few extra clicks, and you want to build a stacked, maximized savings strategy. It's for those who see the long game, where waiting a few months for a $150 travel cashback payout is worth the effort.

You might want to skip it if: You need immediate gratification, get frustrated by technical processes, or make very few online purchases. If the idea of potentially filing a missing claim ticket sounds like a deal-breaker, a simpler portal might offer more peace of mind.

Your First Move

The path to making your spending work for you starts with a single step.

Sign Up (It's Free): Create your TopCashback account.

Do a "Stack Check" on Your Next Purchase: Before you buy anything online, make it a habit: TopCashback first, check for coupons, then pay with your rewards card.

Your money is waiting. Go change where you start your shopping.

Questions?

Email me at coinstocashdollars@gmail.com

Comments